Unpaid invoices : our tips on how to avoid them

Did you know that in France over 40% of invoices are paid late according to an Atradius poll? As a result, every business owner risks having to deal with unpaid invoices at some point. Chasing payments can be stressful and time-consuming, and unpaid invoices can seriously affect your cash flow.

Luckily, there are several ways to make sure your invoices are paid on time.

Here are our tips!

Anticipate billing and advance payments

The best way avoid unpaid invoices is to be prepared. Whether you freelance or have a business, unpaid invoices can put a strain on your activity.

1 - Check your client is solvent

The first thing to do is check that your client is solvent. You can do that by contacting the relevant financial authorities or by consulting online credit checking sites. In France, it is possible to purchase the official Kbis document which will among other things tell you if the company has gone into receivership or is in liquidation.

In B2B (business-to-business), check that your client has an active company registration number (like a SIRET in France). If it doesn't, it's bad news!

2 - Draw up a contract

To avoid unpaid invoices and chasing payments we recommend a lawyer draw up a contract, or any type of document that will allow you to manage your relation with your customer, by clearly defining the terms and conditions of the job and payment.

3 - Have a signed quote or order form

This is business 101! As proof that your quote has been accepted it is essential that you have one in your possession.

If you send price quotes by email, make sure that your client sends you signed confirmation that they accept the offer and the terms and conditions.

Include legal notices in your quotes

Receiving a signed and approved price quote is the best indicator that the terms and conditions of an assignment have been accepted but make sure to include legal notices! A certain number of them must be included in order for the quote to be binding and protect you in case of late payment or a legal dispute.

Include penalties for late payment

Once your quote or order form is drawn up, you can include penalties in case of late payment. Once the client knows how much they can amount to they will be more reactive when it comes to settling the bill. Penalties can be applied as soon as the payment due date has passed.

It is not necessary to send a payment reminder before applying the penalties. Last but not least, don't forget to mention them on your invoice.

⇨ From what point is a payment considered late?

A client is considered late-paying if they have not paid within the payment term stated on the document they have signed (quote, contract, order form).

Request advance payment

Asking for a deposit or an advance payment is a great way to avoid unpaid invoices. If your price quote is substantial, ask your client for one. This minimizes the risk of financial losses and avoids cash flow problems, even in the event of the balance not being paid on time. The advance is usually 30 to 50% of the total amount.

Paying made easy

To minimize the risks of late payments, make it easy for your clients to pay.

You can offer payment in monthly installments, meaning your client doesn't have to pay the full amount at once.

To make things even easier, add an automated online payment feature to your invoice. Have you considered direct debit or bank card payment?

Tools to track your invoices

Avoiding overdue or unpaid invoices requires up-do-date bookkeeping.

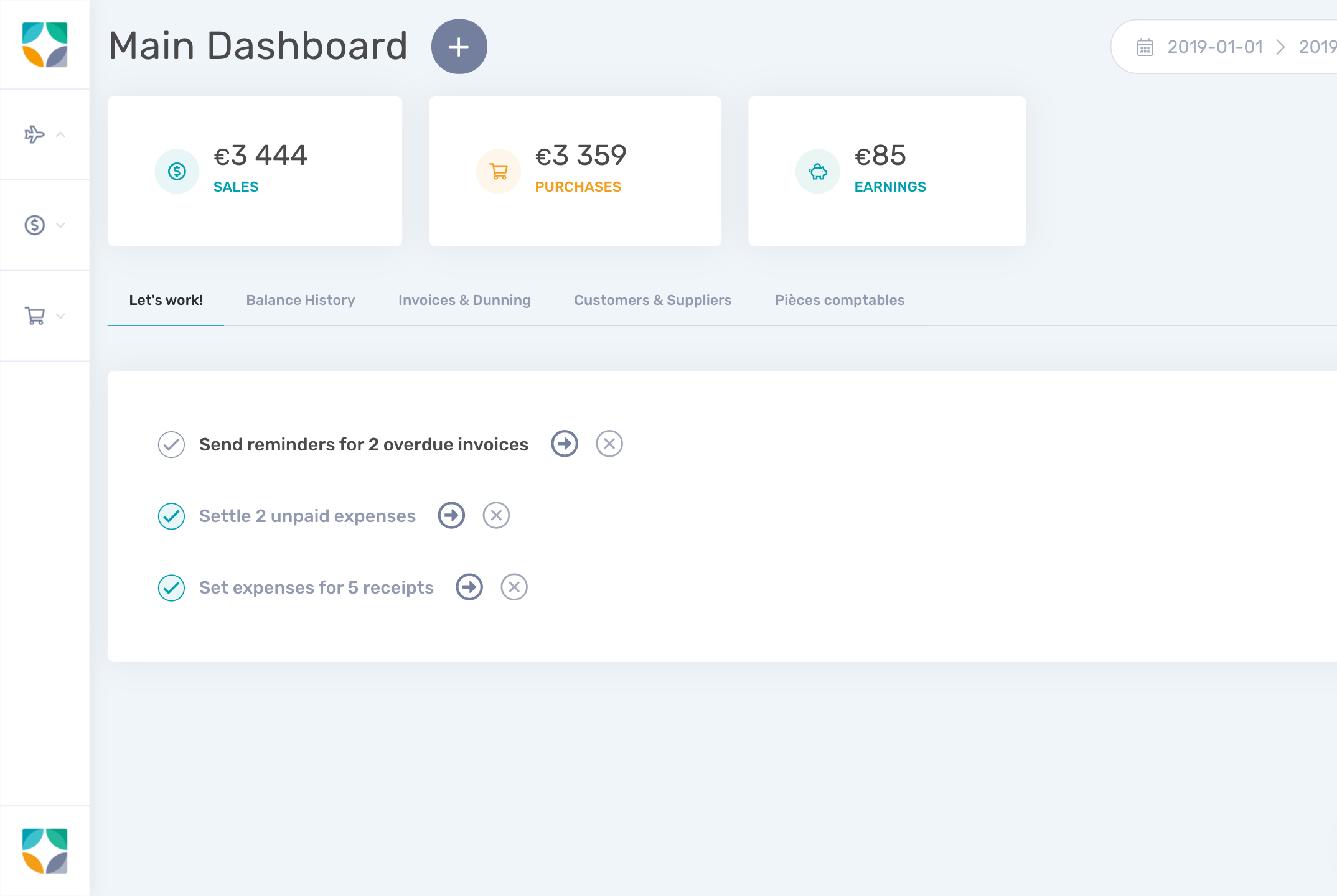

In order to save precious time, avoid invoicing errors and chase unpaid invoices at the right time, use invoicing and billing software.Silex allows you to track invoices and set up automated reminders. The automatic tracking of your income via your bank account lets you know immediately when there is a risk of late payment.

Example of unpaid invoice tracking on the silex.pro dashboard: